Financial uncertainty is testing banks, but they can’t lose sight of customers’ rising service expectations and how they affect their ability to attract new and retain current accounts. Even as banks face growing pressure to lower costs, they also must speed up operations, identify new revenue opportunities, and remain competitive in a regulated and data-intensive environment. IT investments in cloud infrastructure must accelerate the data journey to enable business innovation, personalize the customer experience, and increase operational efficiency.

In this article, we focus on an area where banks can give customers a better experience with targeted technology investments: Opening and onboarding digital accounts.

Opening doors for customers and institutions alike

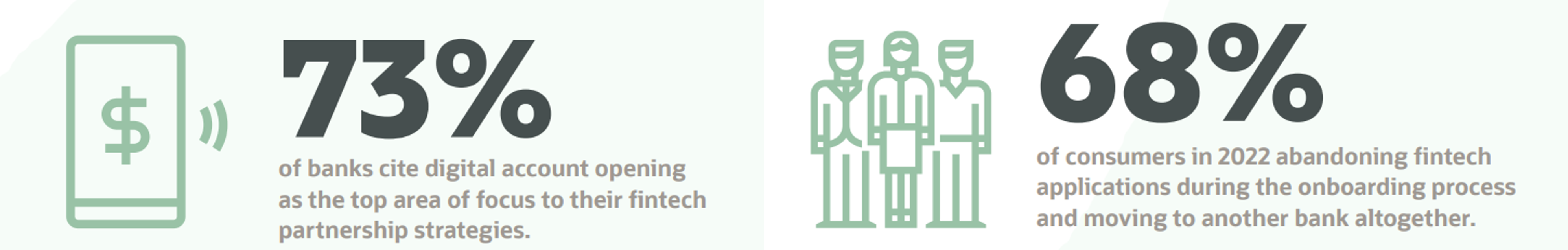

The time it takes to onboard a new customer is critical for banks to get right, with 68% of consumers in 2022 abandoning financial tech (fintech) applications during the onboarding process and moving to another bank altogether (up from 63% in 2020). Digital account opening and onboarding must be a top strategic imperative for banks. According to Cornerstone Advisors in 2019, 73% of banks cite digital account opening as the top area of focus to their fintech partnership strategies.

The experience doesn’t meet changing customer demographics or expectations. Several issues are thwarting this objective: Poor user experience because of inefficient and manual back-office processes, lack of integration with established systems, such as digital wallets and identity verification sources, and lack of consumer confidence in banks to secure their data and maintain privacy.

For banks to deliver frictionless, user-friendly account opening and onboarding, they need substantial improvement in the supporting technologies and services. Oracle Cloud Infrastructure (OCI) provides these services, such as self-service, automated, and remote data capture mechanisms for identification, documents, and e-signatures. These services enable flexible multichannel approaches to account opening and onboarding. With stronger infrastructure, banks find that they can get to a 15-minute maximum application process and onboarding within two days.

Digital account opening and onboarding solutions on OCI include the following features and services:

-

Low-code UI development platform to rapidly develop and deploy web and mobile apps that streamline the application process

-

Autonomous Database to store, manage, and secure data with minimal IT overhead

-

Digital Assistant chatbots that can handle simple service requests, reduce demands on tellers, and provide the preferred customer experience for many situations

-

AI Vision service for extracting data from ID documents at scale, using image uploading and parsing

-

Integration Cloud to rapidly create connections to systems (KYC and AML), applications, databases, and business processes, with more than 70 prebuilt adaptors

-

Process Cloud for a point-and-click, drag-and-drop to create business process automation, which automates the entire end-to-end account opening and onboarding solution to maximize efficiency

A real-world use case

Customers have rising expectations when it comes to digital account opening and onboarding. Financial services leaders are using OCI to improve customer experience and increase profitability.

Letsbank, a digital Brazilian bank based on the concept of open banking, facilitates transactions to nonbank partners and customers. It needed to support an expanding product line and enhance the customer experience. It moved to cloud infrastructure to improve security, reliability, and scalability compared with its on-premises environment.

By moving Letsbank’s app to Oracle Exadata Database service on OCI, performance drastically improved, with scalability to one million API calls with other non-bank partners expanding the ecosystem. Letsbank has also reduced the number of transaction losses from machine failures and improved the security and reliability of its service. The company has the financial flexibility to pay only for capacity used, which reduces overall costs, because the bank is no longer forced to pay for a set number of transactions.

“With Oracle Exadata Database Service, we’ve gained flexibility and the assurance that if there’s abrupt growth or a spike, the bank will support that load,” says Vitor Oliveira, head of Cloud and DevOps at Letsbank. “We’ve also improved performance by 2,000 percent, as well as security, and reliability.”

Want to know more?

To learn how banks can accelerate the account opening and onboarding process, improve abandonment rates, and meet modern day customer expectations, watch the replay of the Accelerate Bank Account Opening and Improve Customer Experience event and demonstration.

This article is part of a series on cloud-enabled innovation in the financial services Industry. Check out related editorials on credit card anomaly detection and loan origination.