Thanks to Mathew Baldwin and Muhammad Abdel-Halim for their significant contribution regarding Oracle Integration Cloud and its security aspects and to Larry Wong for OCI financial services.

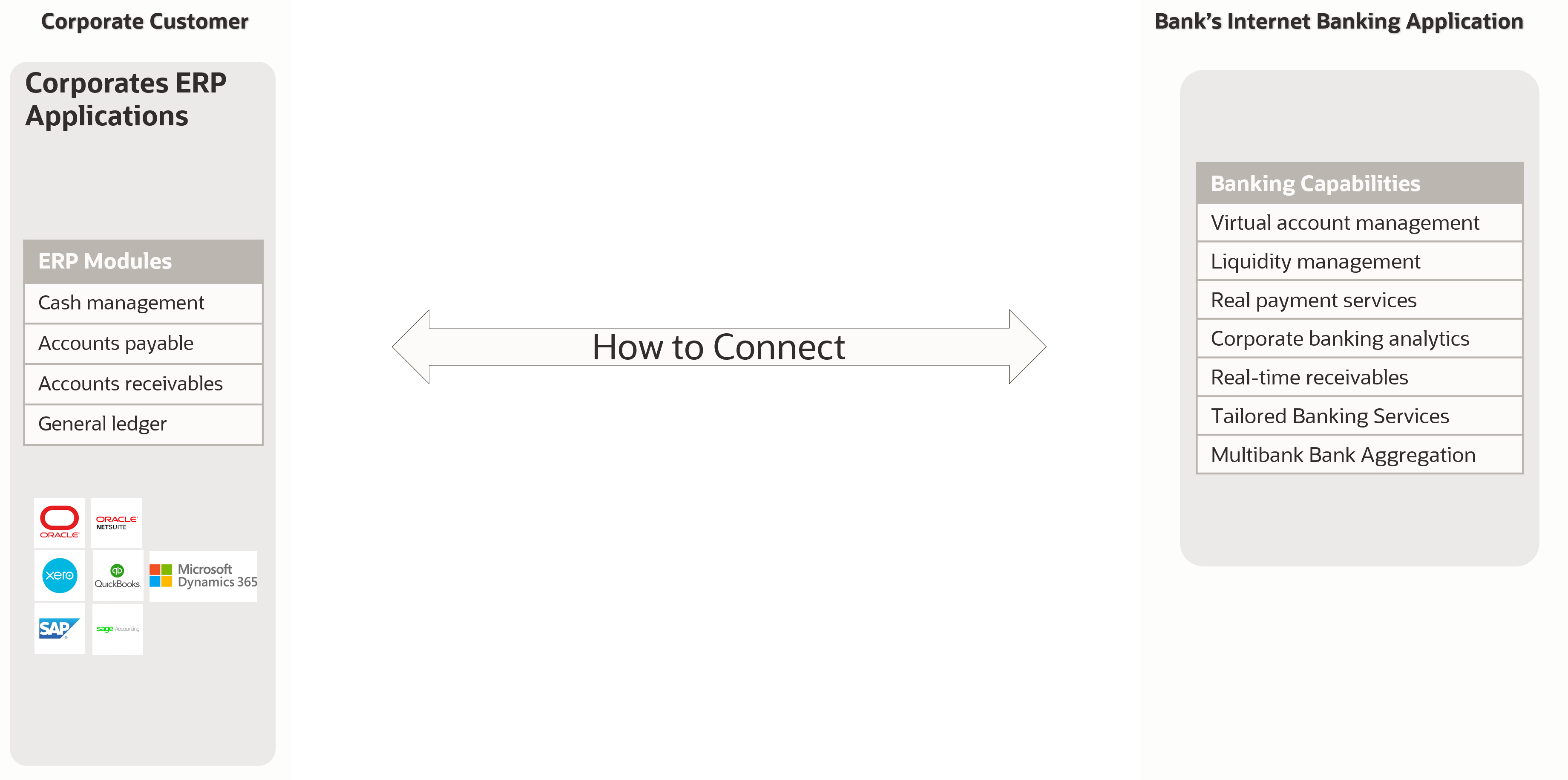

Enterprise resource planning (ERP) is a system of records for tracking and managing all an organization’s financial needs. However, currently corporations manage their financial relationship with banks through the bank’s corporate online banking portal and, in some cases, through the mail. Managing financial transactions might include keeping track of their cash positions, salary file processing, vendor payments, or analyzing the overall financial health of the organization. So, corporations must use multiple independent applications to manage and track their financials, leading to more opportunity for error.

Customers often ask how they can connect to bank systems through their ERP: How can the bank bridge the gap between an organization’s ERP and the bank’s online systems? How can interactions with the bank can be simplified for organizations? Can we embed banking in ERP and have it be secure and user friendly? All these are common questions during our technical and functional sessions with banks’ architects, and answering them led to the inception of the Oracle Embedded Finance platform, bridging the gap for customer interaction between banks and ERP portals.

Oracle Embedded Finance

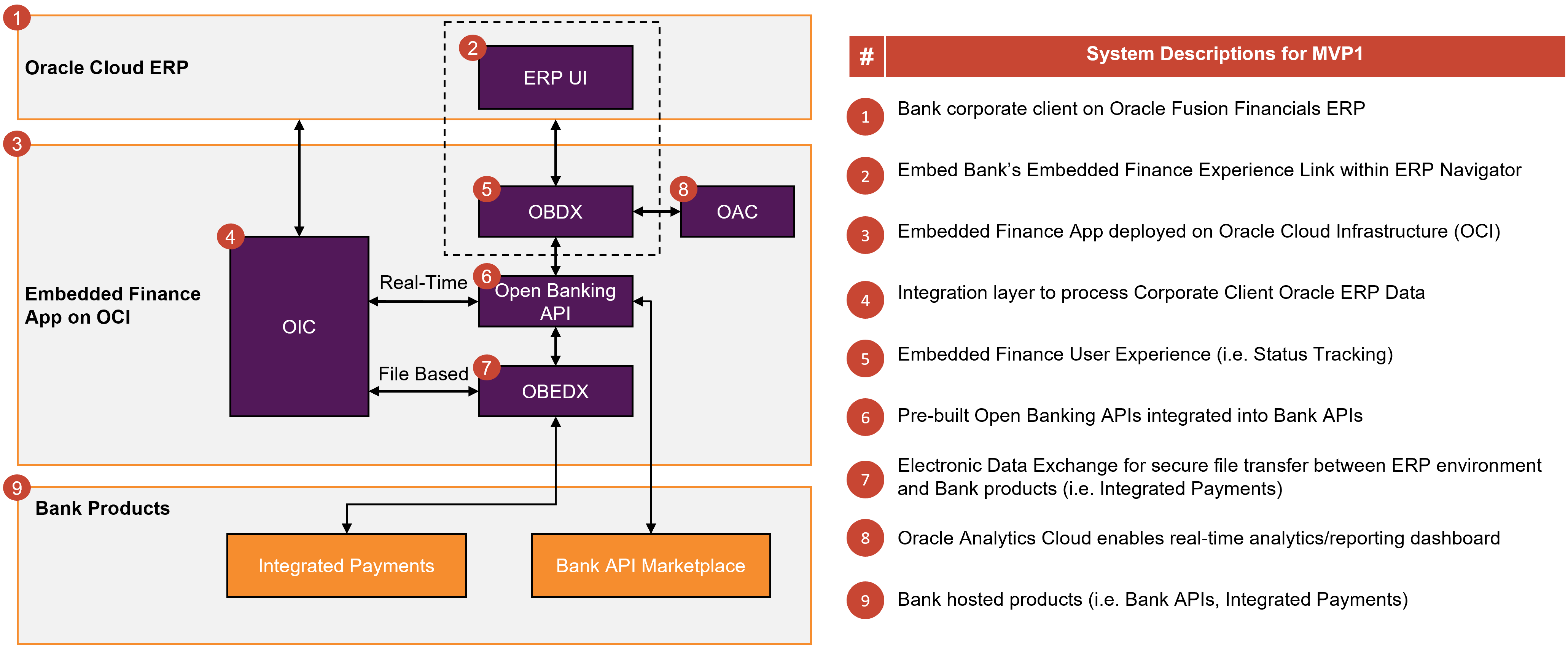

At a high level, a simplified diagram of Oracle Embedded Finance looks like the following graphic:

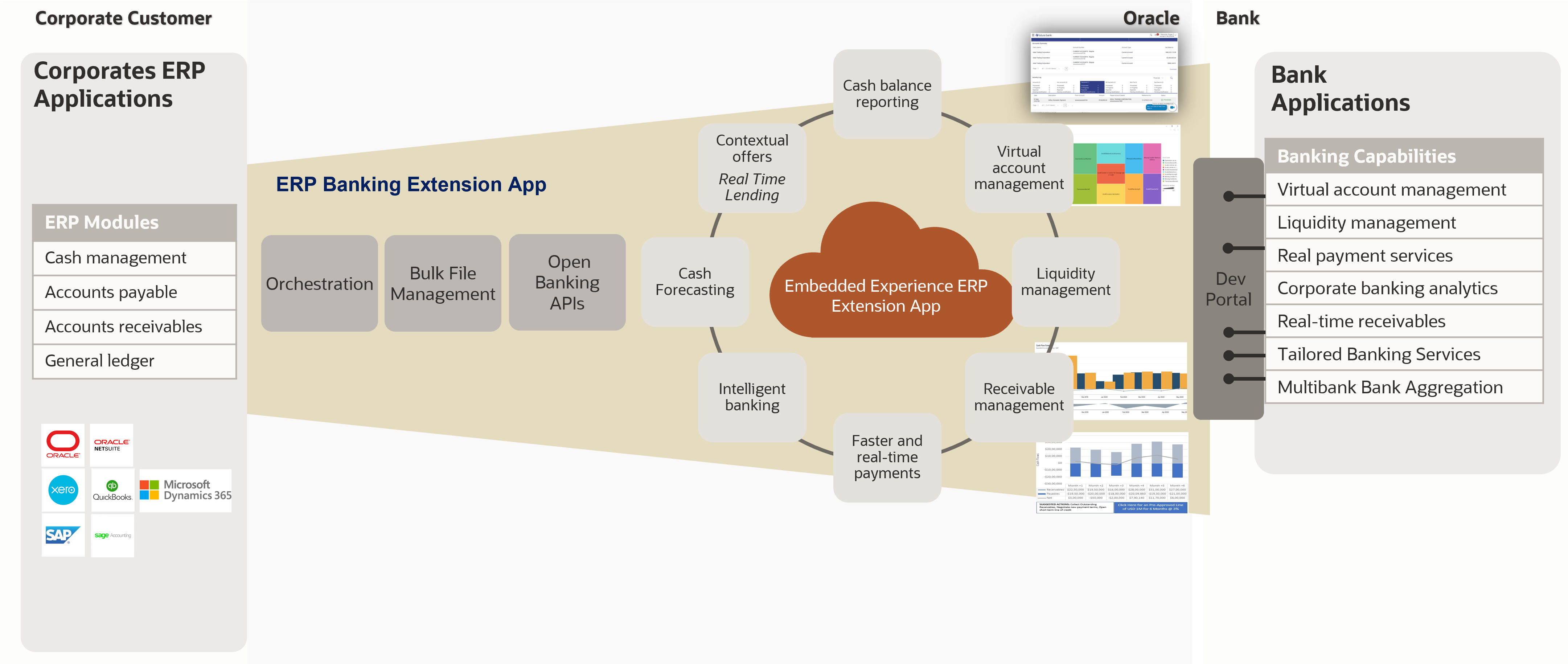

The challenge is connecting multiple ERPs seamlessly to the embedded finance platform. Before we investigate how Oracle addressed this issue, let’s take a closer look at the types of possible interfaces and user experiences we have with ERPs. Depending on what the ERP supports and what the bank wants to enable us for its customers, Oracle Embedded Finance provides the following options for transaction processing:

-

Open API: From ERP screens, you can initiate a single payment or series of payments by consuming embedded finance APIs. Embedded finance platforms publish the APIs, which are consumed by the ERP.

-

Embedded experience: This enables embedded finance screens to be enabled and visible from within the ERP. Single-sign-on between ERP and embedded finance allows embedded finance screens available in the ERP.

-

Data exchange management: The ERP pushes a file with transactions for processing. The file received by ERP is sanitized for errors before pushing it to the bank application for processing as a file or individual API calls.

When building the Oracle Embedded Finance platform, we relied on the following applications for functional and integrational support for ERP transactions:

-

Oracle Banking Digital Experience (OBDX): Apart from providing the administrative interface to setup the embedded finance platform, OBDX also provides the support for Embedded Experience. A labeled OBDX dashboard is displayed within ERP to give a user seamless experience.

-

Oracle Banking APIs: Publish APIs that ERP consumes for financial and nonfinancial transactions

-

Oracle Banking Electronic Data Exchange (OBEDX): Provided interface for file-based transactions

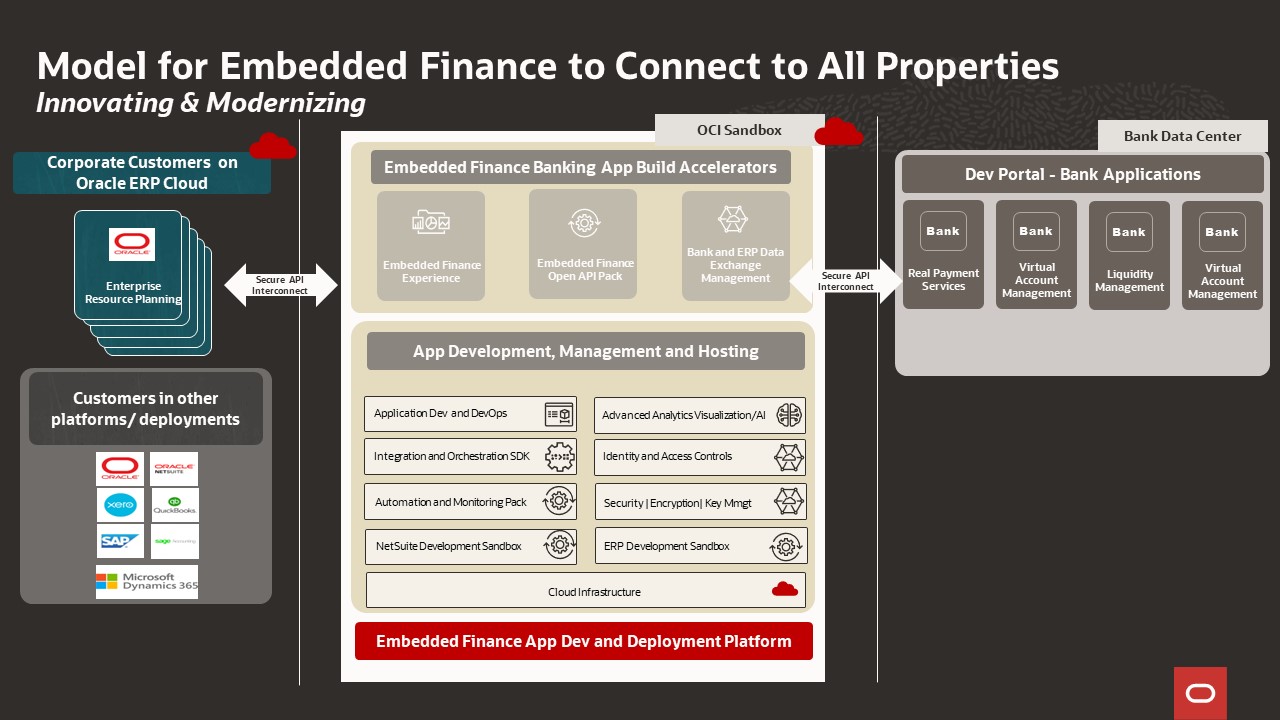

Bringing these applications together, we can address the main question: How does the Oracle Embedded Finance platform mitigate the challenge of being ERP agnostic, considering the length and breadth of the available ERP systems in the market? We overcome the challenge using Oracle Integration Cloud (OIC) for message translation and transformation for transactions between ERP and Embedded Finance platforms, deployed on Oracle Cloud Infrastructure (OCI).

OCI offers the following key options:

-

Oracle Integration integrates all ERP applications with Embedded Finance applications. The OIC capabilities include message transformation, message translation, and orchestration of all incoming message from different ERP solutions to embedded finance applications.

-

Identity and Access Management (IAM) provides support for authentication and single sign-on with ERP for embedded experience. OCI IAM solutions secure access to enterprise applications for both cloud and on-premises deployments. Security, Encryption, and Key Management provide the overall security framework for the end-to-end processing of transactions on the platform.

-

The NetSuite Development SaSandbox and Oracle NetSuite Adapter enable you to create an integration with a NetSuite application. NetSuite is a software-as-a-service (SaaS)-based application for business management. The NetSuite platform includes ERP, customer relationship management (CRM), professional services automation (PSA), and e-commerce capabilities. To integrate users, NetSuite provides a platform called SuiteCloud that consists of cloud development tools and infrastructure. The SuiteTalk component of the SuiteCloud framework enables the integration of NetSuite with other on-premises or cloud solutions.

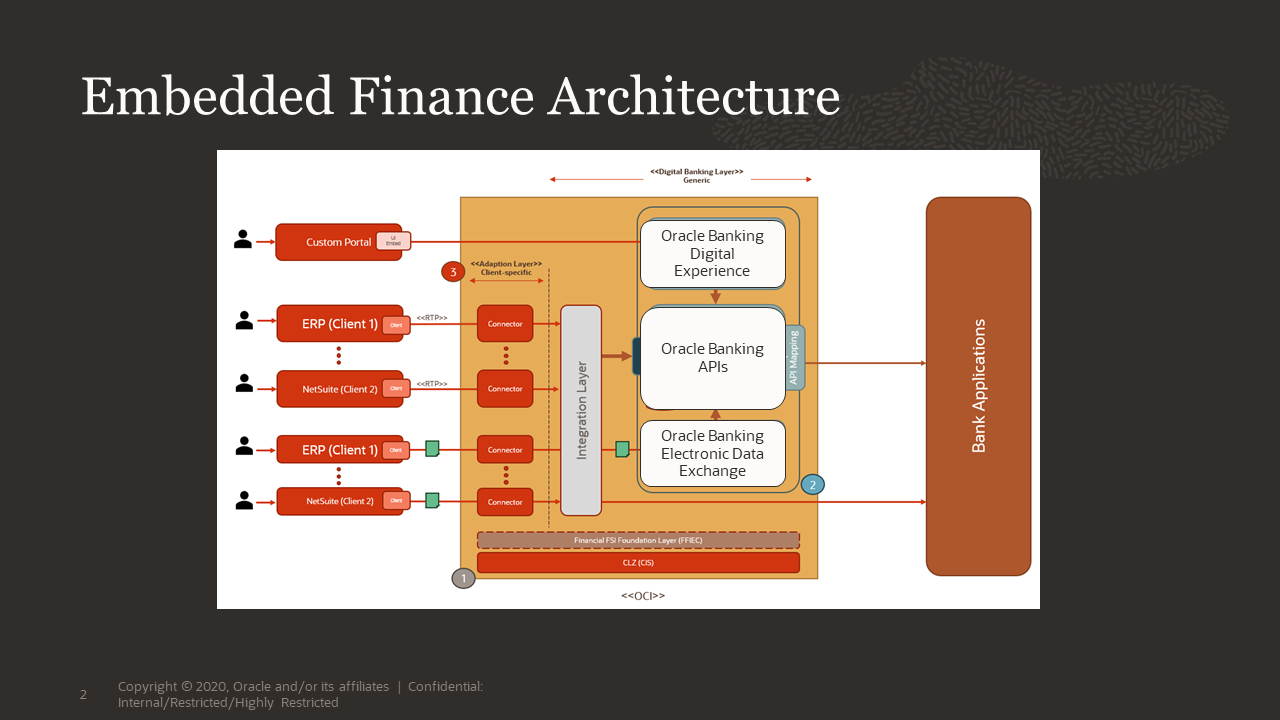

The following diagram represents simplified view of the overall transactions flow on the Embedded Finance platform with the components:

-

Oracle Cloud Infrastructure hosting EF Platform

-

Embedded Finance integrating with bank’s on-premises and cloud systems

-

OIC for seamless integration of ERPs with Embedded Finance

-

Embedded Experience: Embedded Finance UI screens shown within ERP

-

ERP systems consuming APIs published by Embedded Finance

Let’s look at an example of a sample transaction flow as part of the Embedded Finance platform:

-

Bank corporate client on ERP

-

Embed bank’s Embedded Finance experience link within ERP navigator

-

Embedded Finance app deployed on OCI

-

Integration layer to process corporate client ERP data

-

Embedded Finance user experience, such as status tracking

-

Prebuilt open banking APIs integrated into bank APIs

-

Electronic data exchange for secure file transfer between ERP environment and bank products, such as integrated payments

-

Oracle Analytics Cloud enables real-time analytics and reporting dashboard

-

Bank-hosted products, such as APIs and integrated payments

Conclusion

With Oracle’s EFP, banks can further improve their service offering to allow corporate users to access and transact on their bank accounts by reducing the number of bank systems a corporate user has access to. Oracle’s EFP increases efficiency by reducing the manual intervention of uploading and downloading files and transactions from ERP and posting the bank’s systems by seamless straight processing of transactions from ERP. Banks can reduce the overall cost by reducing the number of applications to be managed and, most notably, the tangible benefits of providing better customer servers to the corporate users.

For more information, see the following resources: