We’re excited to announce that Oracle Banking Platform is now validated on Oracle Cloud Infrastructure (OCI). OCI is the only cloud infrastructure that delivers the scale and performance of the public cloud to your cloud native and key enterprise workloads alike. At the same time, it reduces operational costs by up to 40% and gives 55–100% better price per performance. Banks that use Oracle Banking Platform can quickly move to the cloud and experience better performance while improving security compliance.

Oracle Banking Platform

Oracle Banking Platform is a componentized, core banking solution that helps banks progressively transform their business models by streamlining and automating business processes, adopting new distribution strategies, and implementing key enterprise services. It provides a comprehensive retail banking platform: A single deposits platform and a lending platform optimizing service, productivity, and cost of back-office processing, underpinned by enterprise foundational services.

The platform is a true native service-oriented, core banking application that allows banks to break down each element of their architectural system. So, banks can handle each element on its own without affecting existing components. The platform incorporates the following features:

-

Component-based design that provides deployment flexibility

-

Open standards-based middleware that enables a high level of configurability

-

Industry-standard reference process models and a domain-driven, business process-based architecture

-

Standards-based security and localized out-of-the-box compliance for USA and Australia

IT innovation and simplification

Oracle Banking Platform is designed and engineered for global banks looking to transform and overhaul their legacy systems. It comprises both banking-specific applications and enterprise applications, built on Oracle Fusion Middleware products and Oracle Database technologies. Banks can make technology upgrades or replacements piece-by-piece at their own pace, enabling them to balance innovation and simplification. The services are built to enterprise-grade standards and can be deployed at the application or enterprise level.

With Oracle Banking Platform, banks can choose either a process-led or component-led approach to progressive transformation, based on their business priorities and risk appetite. The solution provides banks the flexibility to phase their transformation agenda into smaller bite sizes, replacing obsolete DDA platforms, overhauling the customer architecture, reengineering originations, and uplifting distribution capabilities.

Considerations for deploying or migrating Oracle Banking Platform on to cloud

-

Data regulations: Highly regulated industries, like banking, demand high performance, scale, availability, and security, while operating under strict compliance and data protection requirements. OCI is available in 29 regions, with plans to add another nine regions by the end of 2021. Oracle has a dual in-country, disaster recovery strategy for data centers to be closer to customers and prohibit protected data, such as personal financial profiles, from leaving the country or violating any regulatory requirements around data sovereignty.

-

Security: OCI lets you run applications, including Oracle Banking Platform, in a highly secure environment, using services that are compliant with a wide range of standards and requirements. OCI is FIPS 140-2 Security Level 3 and offers full-stack protection such as customer isolation, internal-threat detection, end-to-end encryption, and automated threat remediation.

Deployment architecture

OCI offers predefined solution tiers of high availability and disaster recovery, with the flexibility to use best-in-class products, such as Exadata Cloud, Autonomous Database, and Oracle Banking Platform. Seamless support from Oracle enables quicker diagnosis and resolution of all issues, both hardware and application. This support mitigates the risk of business interruptions. Banks that shift Oracle Banking Platform onto OCI can realize significant cost benefits and positive impact on their EBITDA with approximately 50% lower total cost of ownership versus on-premises, with BYOL for all database services. Banks can migrate to OCI in only weeks, not years. They can now scale up or scale down infrastructure based on business demand, enabling a pay-as-you-go pricing model.

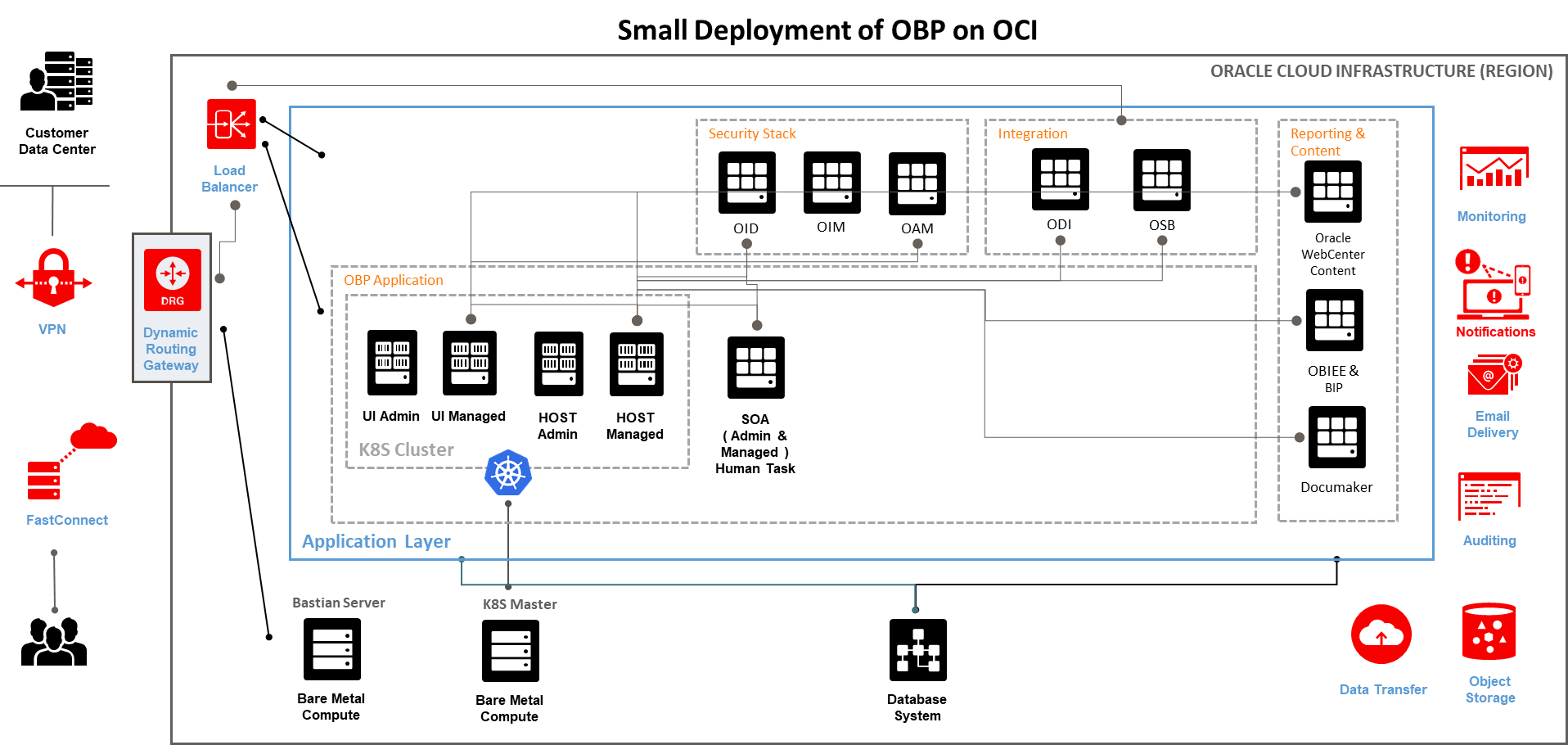

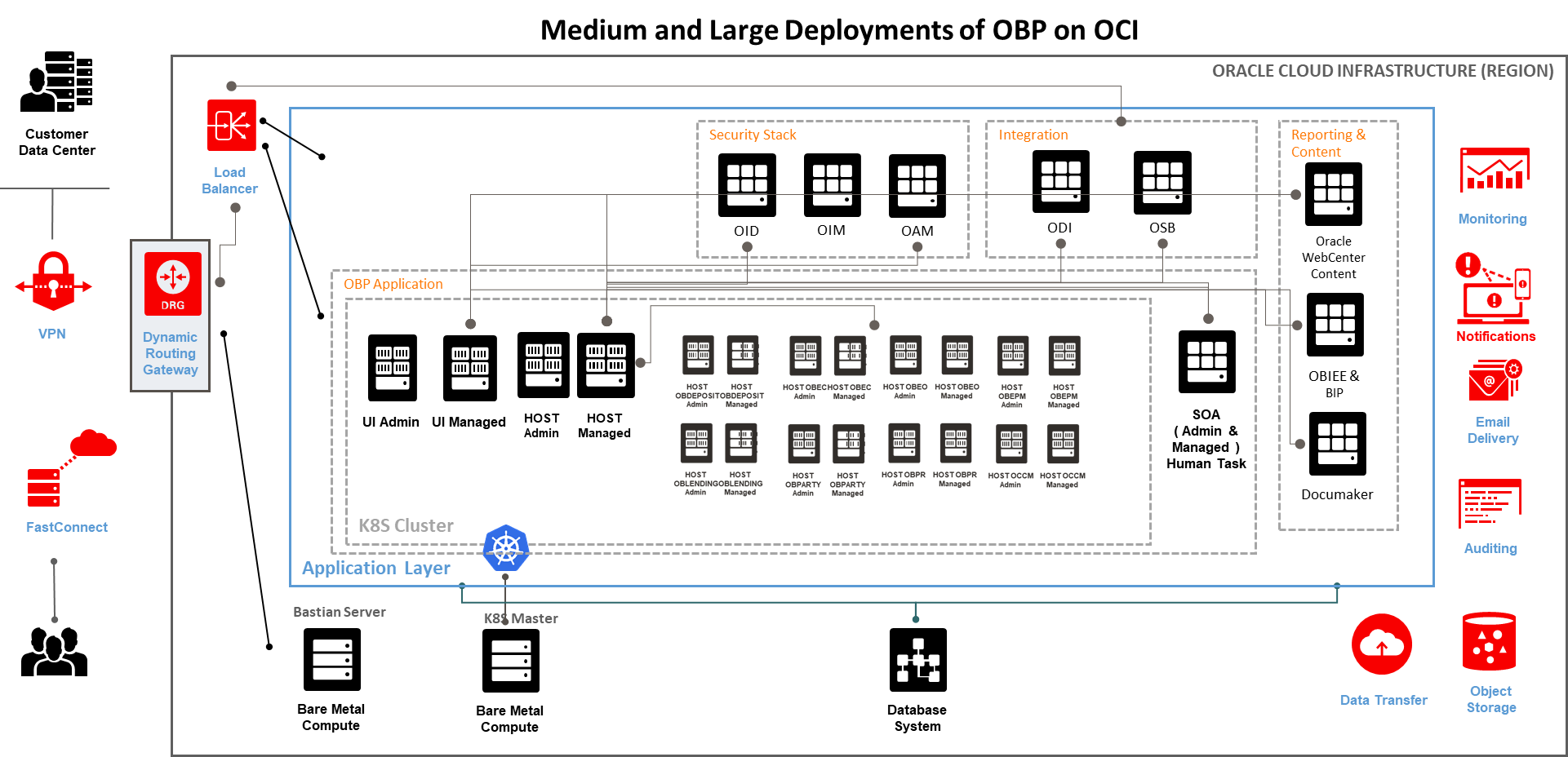

The following reference architecture shows a highly available topology for deployments of Oracle Banking Platform on OCI.

Try Oracle Cloud Infrastructure today

You can select either Oracle Cloud’s Always Free services or a 30-day free trial, which includes US$300 in credit to get you started with a broader range of services. To learn about their options for cloud, existing Oracle Banking Platform customers can discuss their infrastructure plans and roadmap with their Oracle representative migration. The entire migration process uses a light touch, enabling customers to realize immediate cost and performance benefits.