We’re pleased to announce that the entire suite of Oracle Financial Crime and Compliance Management (Oracle FCCM) enterprise applications is now validated on Oracle Cloud Infrastructure (OCI).

This announcement is great news not only for chief compliance officers, whose teams use these applications, but also for chief technology officers who can now bring this suite of mission-critical applications along on their company-wide journey to the cloud. In this blog post, I provide chief technology officers with an overview of Oracle FCCM, the benefits of running it on OCI, and some considerations for deploying or migrating these applications.

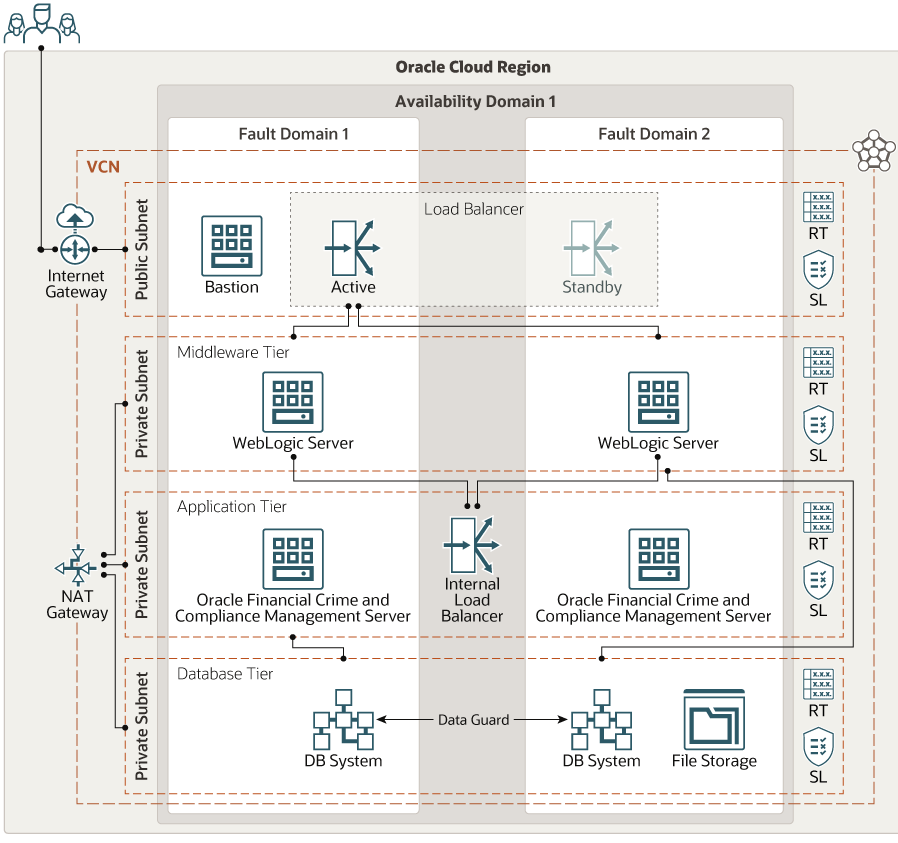

For more information, refer to the following reference architecture: Deploy Oracle Financial Crime and Compliance Management applications in the cloud

What is Oracle Financial Crime and Compliance Management?

Oracle Financial Crime and Compliance Management is a comprehensive suite of applications that help financial institutions fight money laundering and other financial crimes while achieving compliance with related regulations. We support the complete spectrum of anti-financial crime use cases, from customer due diligence to transaction monitoring to investigations to regulatory reporting and management insights.

Chief compliance officers today are under extreme pressure to get their anti-financial crime programs right. They must comply with changing regulations across jurisdictions and ensure that they perform sufficiently rigorous customer due diligence and transaction monitoring, or face fines and reputational damage. At the same time, financial criminals are constantly upgrading their schemes, networks, and technologies, while customers demand new products, superlative experience, and airtight security. Financial institutions are trying hard to address these pressures by filing more suspicious activity reports (SARs) with regulators, sharing information with each other and expanding their anti-financial crime teams. But they face impediments, such as overworked compliance staff, alert backlogs, disparate systems, and tedious processes.

That’s where Oracle comes in. Our applications enable chief compliance officers to protect their customers and their business, achieve compliance over the long term and use their investment in anti-financial crime to support business growth. We can achieve this with the following benefits:

-

A strong, data-driven foundation. Oracle FCCM dates back to 1996 for the National Association of Securities Dealers. These capabilities eventually became Mantas, which was acquired by Oracle in 2006. Our clients benefit from a comprehensive, purpose-built, continually enhanced suite of applications, “scenarios” or rules that help a financial institution decide whether an event is potentially criminal, machine learning models, and reports for robust, agile risk mitigation. We also have the industry’s most comprehensive financial crime relational data model, which helps clients realize the full value of their data.

-

Advanced technologies that empower teams. We help chief compliance officers maximize efficiency and effectiveness across their anti-financial crime programs by incorporating the latest technologies from Oracle Labs and the open source community through our Financial Crime and Compliance Studio. For example, we use graph analytics to uncover hidden insights, improve detection, and streamline investigations. We use robotic process automation (RPA) to help teams reduce time spent on data gathering by up to 80%, and AI-powered automations, recommendations, and visualizations to help analysts and investigators optimize their time and focus on the most valuable tasks.

-

Future-readiness. Our systems are easy to manage. We offer seamless, unified solutions and an open, componentized architecture. We’re enterprise-grade, resilient, secure, and cloud-ready. All these things make us easy to deploy, run, upgrade, and scale. We also help chief compliance officers support business growth because we integrate with any core banking solution, so you can use financial crime and compliance data to drive revenue.

Whether you’re looking to make transformational changes to your anti-financial crime program or optimize parts of it, Oracle can help you achieve your goals with our experience, innovation, and enterprise-grade architecture.

The benefits of Oracle Financial Crime and Compliance Management on OCI

Financial institutions might want to consider deploying Oracle FCCM on OCI for the following reasons:

-

Easy upgrades. Oracle FCCM is continually adding new features and incorporating advanced technologies, such as machine learning and graph analytics, into use cases across our application suite. By being on OCI, we can bring these technologies to customer deployments faster while ensuring stability and scalability by having tight control of the technology stack on OCI. Faster upgrades also help financial institutions keep current with constantly evolving global anti-financial crime regulatory demands–with minimal time, effort, and cost.

-

Easy to add applications. Anti-financial crime is an area that’s ripe for transformation, and Oracle FCCM can help clients make a phased transition from legacy rules-only approaches to new approaches that use advanced technologies. For example, a client can first deploy our transaction monitoring product and later deploy Financial Crime and Compliance Studio to enhance detection. Because our applications work off a common data foundation and functionality, ensuring that this common foundation is up to date and that existing application deployments don’t break when bringing on new functionalities can be better achieved when applications are on OCI, and Oracle has control over upgrades of dependent software.

-

Real-time support. Oracle understands the importance of quality support and business continuity for enterprises. Having Oracle applications on OCI ensures the engineering alignment that’s crucial for quick diagnosis and resolution of all issues: hardware, application, and network. This stability mitigates the risk of any business interruptions.

-

Performance. Oracle Cloud Infrastructure is Oracle’s Generation 2 Cloud platform, designed to provide banks with security, rock-solid reliability (disaster recovery and high availability), and powerful capabilities for large and complex deployments—all while beating industry performance standards. Employ exclusive Oracle Cloud products, such as Exadata Cloud, Database RAC, and Autonomous Database, designed for unmatched performance, reliability, and autonomous operations. Banks can use Oracle Cloud’s global footprint and validated reference architectures to ensure data sovereignty, disaster recovery, and enhanced availability–improving the user experience tremendously.

-

Cost savings and scalability. Migration to OCI saves significantly on maintaining data centers, allowing financial institutions to realize an immediate positive impact on their EBITDA by transitioning to a lower-cost, consumption-based operating model: because the cloud is pay as you go, you don’t have to incur high up-front cost. Customers can save money, even while scaling up infrastructure further than on-premises to handle greater business demand and scaling down infrastructure during quieter periods. Overall, OCI beats industry pricing standards, offering about a 50% lower total cost of ownership (TCO) compared to on-premises deployments, and a bring-your-own license (BYOL) model for all database services.

Considerations for deploying or migrating Oracle Financial Crime and Compliance Management to cloud

-

Data regulations. As with any application that handles financial data, Oracle FCCM is subject to data privacy and governance regulations. Thus, financial institutions need to check that OCI has data centers in the countries where data is collected.

-

Security. Financial institutions need top-notch security, and OCI is FIPS 140-2 Security Level 3.

Deployment architecture: Oracle Financial Crime and Compliance Management OCI

Although Oracle FCCM solutions can be customized based on a customer’s needs, a typical deployment consists of a centralized database layer with redundancy through cross-region or availability domain replication, and an application layer that consists of key products. For detailed technical information about Oracle’s validated solution for Oracle FCCM on Oracle Cloud Infrastructure, visit our Architecture Center.

Why Oracle Financial Crime and Compliance Management on OCI is right for you

Oracle Cloud offers the opportunity to streamline operations, improve performance, and reduce costs, which enable businesses to focus on winning their business every day. The ease of consumption, immediate improvement in EBITDA, a highly scalable and secure environment that meets stringent regulatory requirements, and single-vendor setup for applications and infrastructure help companies immensely.

For existing Oracle FCCM clients, the entire migration process to OCI only takes a few weeks, enabling customers to realize immediate cost and performance benefits. Financial institutions that aren’t yet FCCM clients and want to combine the control and flexibility of an on-premises deployment, the benefits of the cloud, and the advantages of Oracle Cloud Infrastructure should discuss their infrastructure plans and compliance program needs with their Oracle representative to learn about their options for Oracle Cloud Infrastructure deployment.

To learn more, message me or join the conversation by commenting.

For more information, visit the following resources: