The procurement function has evolved significantly over time. Modernity — in the form of global supply chain expansion and advancements in technology — has hastened the maturation of the procurement officer’s role from tactical to strategic.

With the expansion of global supply networks, procurement’s initial focus on tactical, day-to-day purchasing operations has broadened to include enterprise-scale strategy on topics ranging from risk mitigation to sustainable sourcing.

As stated by KPMG, “CEOs are looking to the procurement function to take on a broader and deeper set of strategic responsibilities than ever before.”

Procurement leaders are sought after to make decisions affecting many critical business processes. Poor supplier performance or lengthy source-to-settle cycle times, for example, can have downstream impacts on revenue generation, profit margins, warehouse storage costs, and workforce hiring.

Deloitte’s Global 2021 Chief Procurement Officer Survey similarly acknowledges the increased expectations within the procurement role and suggests that “…building capabilities focused on agility is the CPOs’ best bet to meet and exceed them.”

Data analysis provides procurement professionals with the agility needed to meet these increased expectations. Using procurement analytics, executives can surface critical patterns from the vast data sets generated from purchasing transactions, delivery inspections, invoice processing, and more. This empowers procurement teams to isolate profitability drivers and eliminate bias when making purchasing decisions.

The use cases below detail specific examples of how organizations can implement procurement analytics solutions to drive efficiency, cost savings, and risk management decisions.

Accelerate procurement efficiency with analytics

“Driving organizational efficiency” was ranked by CPOs as the #1 business priority in Deloitte’s 2021 Global CPO Survey, surpassing “Cost Reduction” by a slim margin for the first time since the survey’s inception.

While cost reduction will assuredly remain a top benchmark by which procurement officers are assessed, there is a growing consensus building around additional areas of value influenced by the procurement department. According to Deloitte: “It’s no longer just about more products and services at a lower cost, but about a broader range of improvements (e.g., speed to market and innovation enablement) and in many cases ROI.”

Improve procure-to-pay cycle time

Inspecting aspects of the procure-to-pay cycle provides a better understanding of the procurement team’s performance. Benchmarks linked to revenue generation, such as speed of time to market, are influenced by the pace at which critical parts are secured. Source-to-settle cycle times impact the ability to meet demand at its peak or snag market share before competitors. For these reasons, procurement cycle time efficiency affects internal operations and alters the momentum of innovation.

Data comprising the procure-to-pay cycle comes from multiple different departments and is often siloed. Analytics allows procurement teams to connect workstreams and data across the entire enterprise to form an accurate representation of cycle times. The ability to break down a cycle time by its parts enables organizations to surface — and triage — operational bottlenecks that threaten to thwart productivity. Granular visibility into these processes would not be possible without analytics.

For example, as a procurement executive, the efficiency dashboard below allows me to uncover which aspect of my procurement process is delaying the build of my most profitable product. Perhaps, as the chart below suggests, internal approvals are obstructing the flow of purchasing within my organization:

A detailed analysis goes beyond transactional reporting, allowing me to determine which teams or individual employees are prolonging the approval process. Quick access to this level of detail enables our organization to rectify the situation before we experience the rush of seasonal demand.

Analyze supplier performance to minimize disruption

Analytics makes it easier for procurement professionals to support peers’ revenue and profitability goals across the organization by providing process visibility.

Detailed analyses into delivery status and Advanced Ship Notice (ASN) by item type, project code, and other metrics allow companies to maximize productivity while proactively managing customer relationships. Teams can see which goods were ordered and their arrival date at a specific location. When analyzed against current warehouse inventory, organizations gain a complete understanding of their operations, and alert customers or downstream partners of possible delays in advance.

For instance, the manufacturing team’s productivity is hampered by the inability to see whether a critical part needed for production is located within a nearby warehouse, or whether it has been ordered at all. Inventory uncertainty creates idle time/downtime.

Within transactional reporting systems, supply and demand drivers are often kept in separate data repositories. Many employees can only view the inventory on-hand for their facility, rather than an aggregate view of inventory across the business. However, suppose the manufacturing team can see that an essential production part has been ordered, and will arrive at a nearby facility by Wednesday at 2 PM. In that case, they can begin a partial build on Monday. The team will then be well-positioned to continue work when the part is delivered later in the week. Analytics enables companies to bypass workflow interruptions while efficiently using time and resources.

Reduce bottlenecks within invoice and purchase order processing

The age-old adage “time is money” is one that operations and finance professionals alike are familiar with.

In general, the complexity of the process increases operational costs. Combining procurement and financial data for analysis is a crucial first step an organization can take towards streamlining excess logistical complexities across the procure-to-pay cycle.

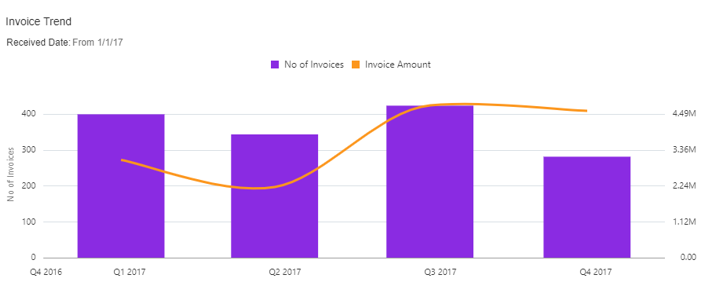

Let’s imagine that I have direct access to a graph that depicts purchase order (PO) dollar amounts by supplier alongside the number of invoices received from each supplier.

When the number of invoices issued by one supplier far surpasses the monetary amount on a contract, it’s a good assumption that the supplier is invoicing my organization for each line item on the PO, rather than producing one blanket invoice. This creates additional work for the Accounting department and increases the risk of accidental late or missed payments for small amounts.

Armed with this knowledge, a category manager can create an improvement plan for this supplier that includes invoice consolidation. Reducing the number of invoices processed streamlines accounting practices, and in turn, saves money in the form of labor hours.

Proactively manage procurement contract expirations

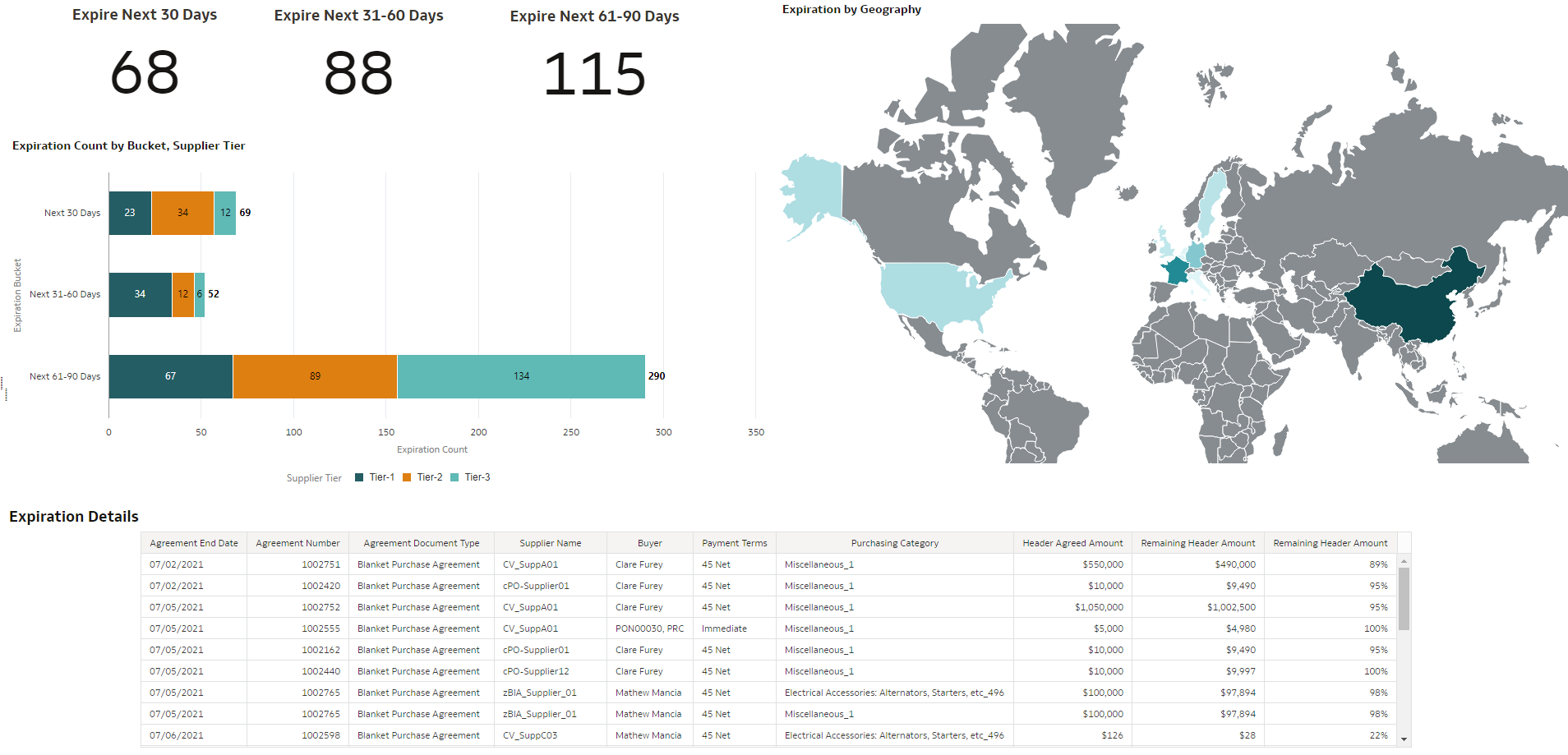

Procurement teams can more deftly navigate contract expirations with the aid of analytics. Tracking all agreements and contract expirations across global operations is a painstaking task that many companies face. Complexity is magnified when attempting to monitor multiple agreements with the same vendor across different categories and geographies. Different contract creation dates and varied category manager responsibilities for each contract add to the complication. It is not uncommon for procurement analysts to spend precious days painfully tracking these expirations by manually copying thousands of lines of contract information into spreadsheets… it’s no wonder accidental contract expiration occurs.

When contract expirations inadvertently slip through the cracks, it can prove a sore inconvenience to recreate the entire contract. This cumbersome process increases logistical processing time, and the renegotiation process always poses the threat of increased pricing terms.

Analytics is a powerful antidote to these complexities. Receiving timely alerts 30, 60, or 90 days before contract expiration eases the mental burden of spreadsheet tracking for procurement officers. With an in-depth procurement analytics solution, users can visualize contract expiration by multiple dimensions, such as product type, country, supplier location, direct vs. indirect spend, and more. High-level analysis also allows procurement executives to track the overall contract execution roadmap from a workload and staffing level; how busy will my procurement officers be with the number of contract renegotiations coming up?

Deliver cost savings with procurement analytics

Despite increased demand for organizational efficiency, Chief Procurement Officers (CPOs) are most commonly held accountable to cost reduction metrics. The expectation remains that an increasing number of CEOs and CFOs will either begin to — or continue to — require CPOs to “deliver cost savings that are visible to the bottom line (with more robust tracking to prove it).”

For the procurement organization, the path to increased margins can be attained by various means, whether by negotiating more favorable pricing rates with suppliers or reducing contract leakage. The key to understanding where to reduce expenditures lies principally within an entity’s spend analysis solution; it becomes nearly impossible to identify cost reduction opportunities without a comprehensive view of spend across the business.

Enhance strategic sourcing negotiations with spend analysis

Buyers and category managers are measured on savings negotiated and realized year-over-year (YoY). Yet without the right tools to measure and track progress, it can be an onerous task to track the company’s price negotiations over time for each supplier and every product managed.

For category managers entering renegotiations with past suppliers, the ability to easily see historical pricing trends for a particular product across all business units– in addition to pricing received from competitors — can serve as a benchmark for cost reduction.

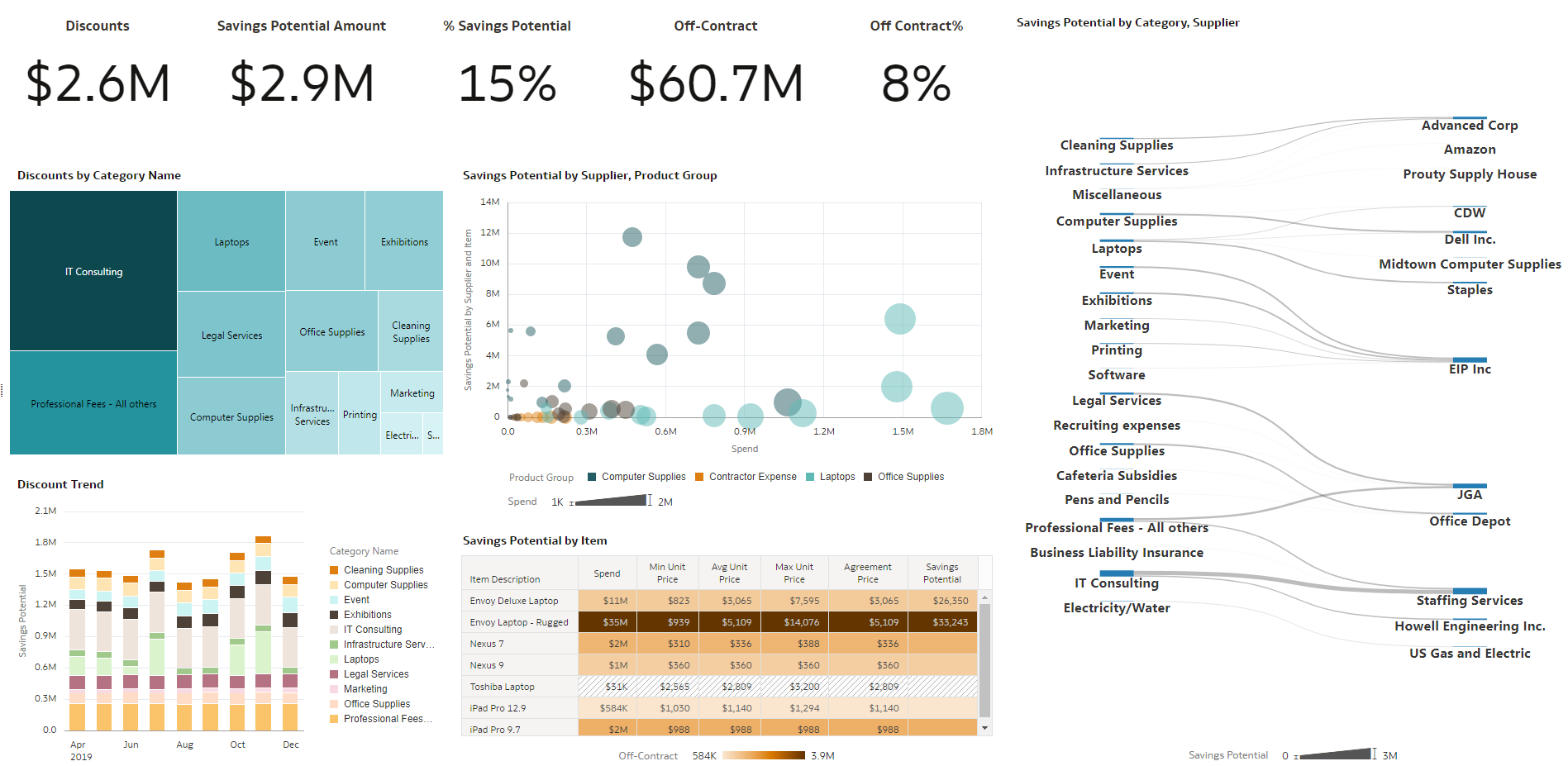

Visualizing discounts received for a specific set of goods over time also allows the procurement organization to optimize negotiations. The procurement analytics dashboard below illustrates spend analysis information alongside “savings potential” by product and supplier.

With the right analytics tools, procurement teams can arm themselves with salient data points to improve their position during contract negotiations and can reduce off-contract spend on a granular level.

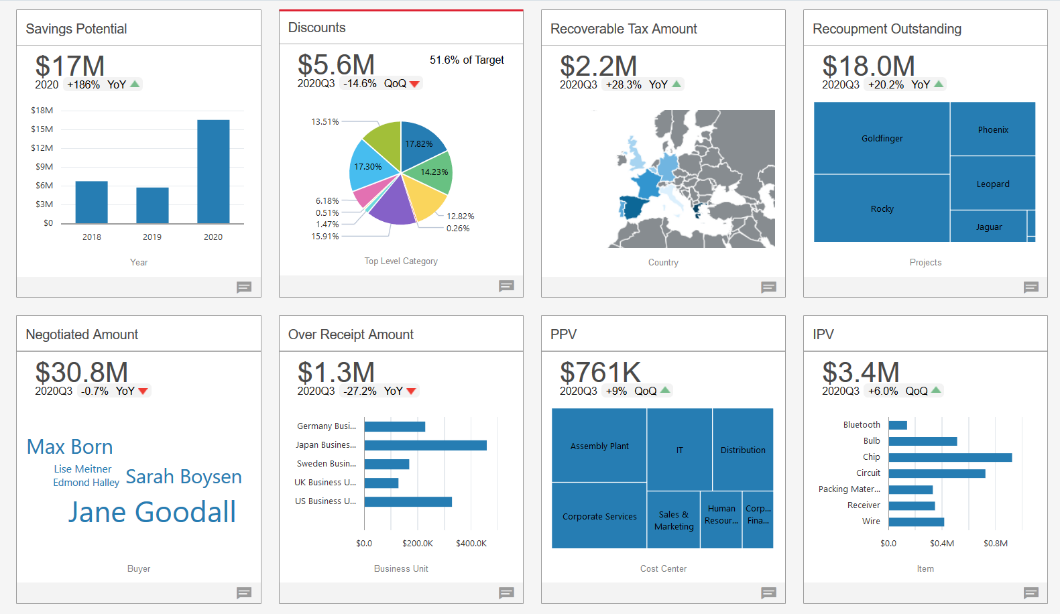

Realize greater savings with Invoice Price Variance (IPV) Analysis

It is equally important to track negotiated pricing against invoice amounts to determine the organization’s realized savings.

Negotiated discounts are meaningless if data from finance and procurement departments have not been synchronized to ensure that the rate negotiated matches the price paid. Getting these metrics is often time-intensive and complex due to the data integration and manipulation needed to combine outputs from different sources.

It is imperative to invest in procurement analytics software that makes this critical matching process easy. By speedily surfacing Invoice Price Variance (IPV) trends, companies can uncover instances of inadvertent overpayment. Perhaps one supplier, in particular, is guilty of making this error consistently — once discovered, this becomes an easy fix with a phone call to their accounting department.

Reduce rogue spend with contract utilization and contract leakage analysis

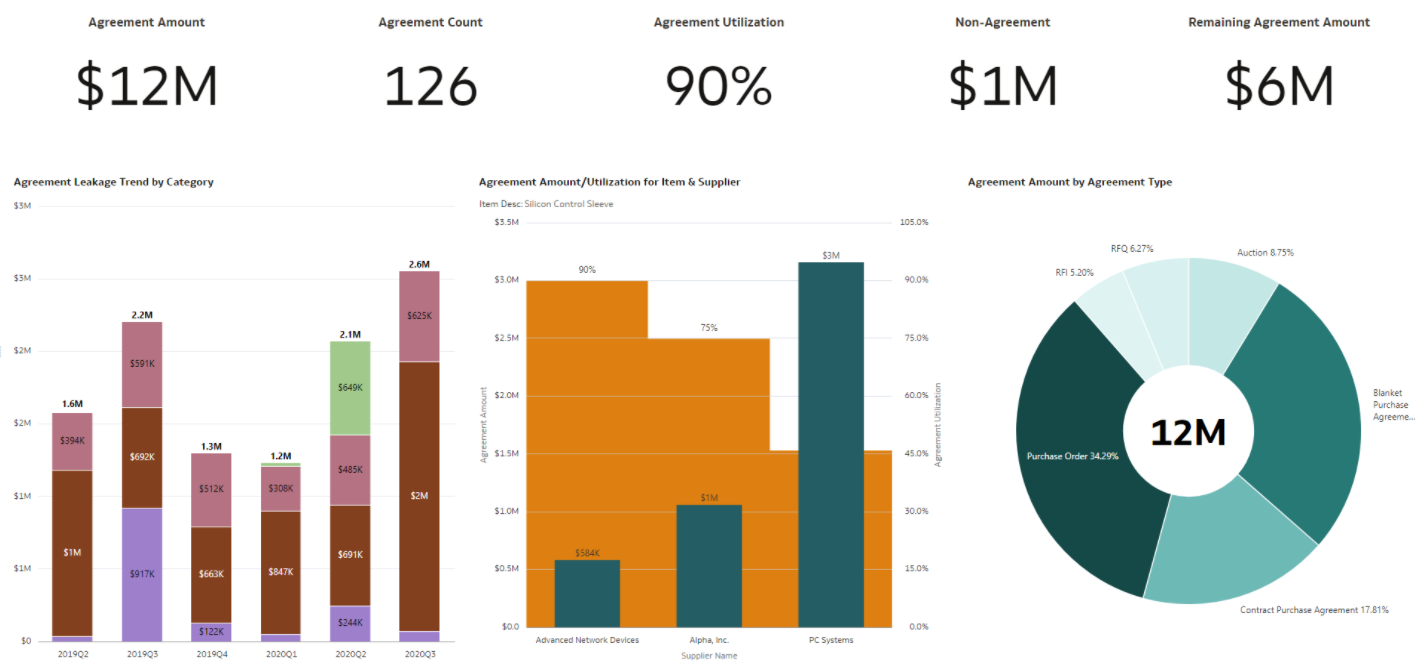

Analysis of contract utilization and contract leakage by category, business unit, and item allows buyers to assess how well they’ve procured products and services that closely match business needs. Category managers can negotiate more favorable rates for items on an agreement, but this proves ineffective if employees ultimately purchase that item off-contract, or don’t use these products at all.

Let’s imagine that my top 10 items procured account for 90% of my utilization, and the rest of my items – 140 of them – are seldom being purchased. However, my off-contract spend for a similar category is very high. This is a clear signal to investigate this discrepancy further — should I fold the off-contract items into my agreement for the next negotiation cycle? By looking at agreement utilization by item and supplier, buyers can more accurately predict the amount and type of goods needed, thereby reducing wasteful spending.

As pictured in the visualization above, agreement utilization analysis can help identify opportunities to realign agreements and contracts with purchase needs. Insights into agreement utilization trends can be used to increase spend under management. In the example above, the graph of “agreement amount” versus “agreement utilization” reveals that internal demand for silicon control sleeves from supplier Advanced Network Devices is far greater than demand for the same item from other suppliers. Procurement can use this information to shift future agreement amounts with each supplier to better align with company purchase preferences, thereby reducing rogue spend.

Mitigate Procurement Risk

Full visibility into a company’s entire value chain can be elusive, yet transparency into supplier risk and performance is paramount when it comes to identifying unhealthy sourcing dependencies or mitigating unforeseen disruption. With the help of analytics, procurement professionals gain the tools to navigate the ever-looming threat of volatility.

“…most businesses do not have a good idea of what is going on lower down in their supply chains, where sub-tiers may play small but critical roles. That is also where most disruptions originate, but two-thirds of companies say they can’t confirm the business-continuity arrangements with their non-tier-one suppliers.” – McKinsey [link]

Reduce sourcing risks with increased insight into supplier performance

Lack of organization-wide knowledge of supplier performance trends permits low-performing suppliers and vendors to negatively impact downstream deliverables.

Analyzing spend data with supplier performance metrics enables organizations to understand the many tiers of their supply base and helps companies assess the potential for disruption stemming from each vendor.

“The ability to detect, measure, and manage risk remains a challenge…Our research found that very few CPOs (18%) were formally tracking the risks that existed in their direct (tier 1) supplier base, and only 15% had visibility beyond that.”— Deloitte Global 2021 Chief Procurement Officer Survey

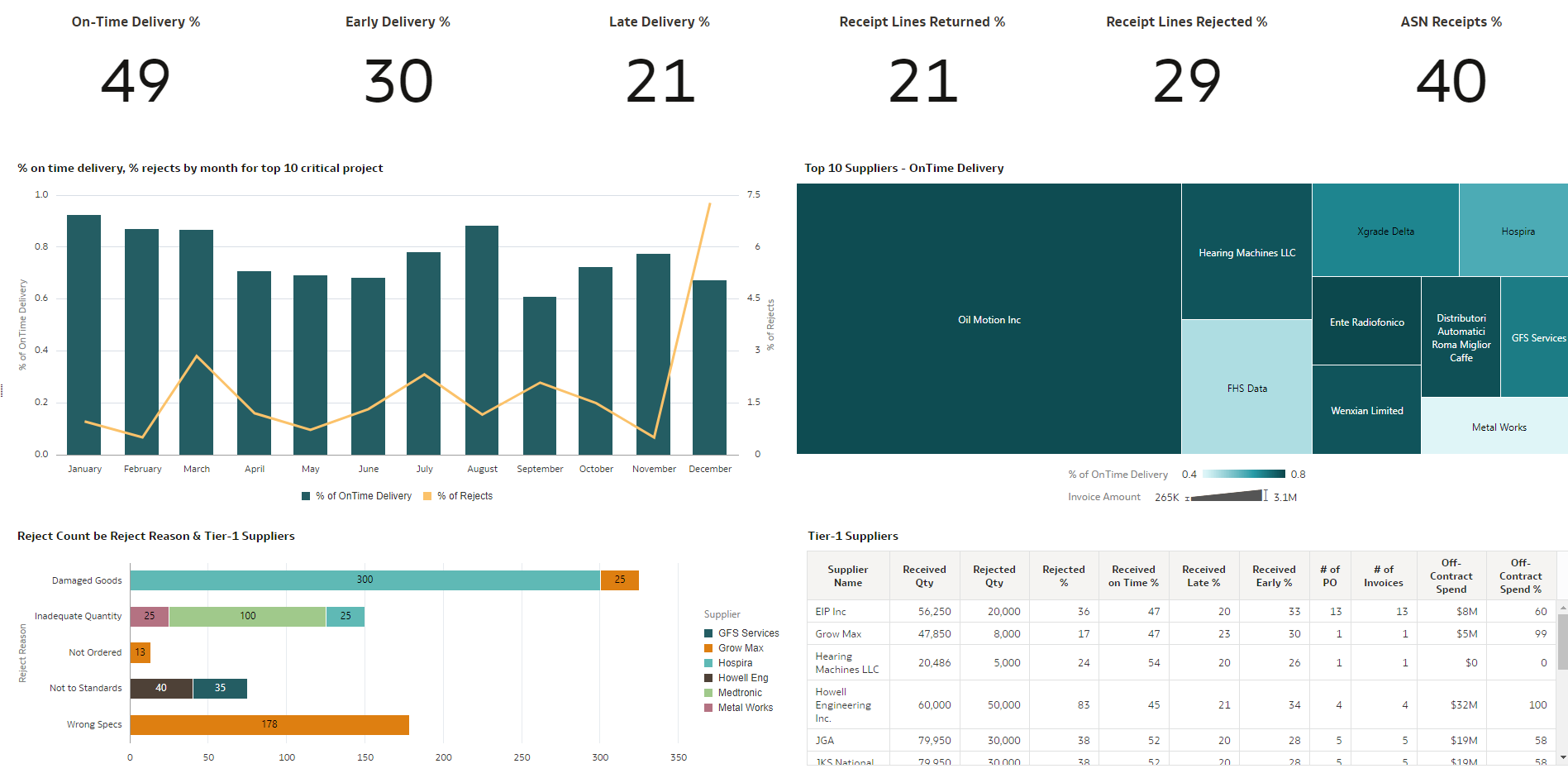

Knowledge of supplier performance by on-time delivery, accepted, rejected, shipped, short-closed, and return rates enables the optimization of purchasing and facilitates strategic supplier management.

For example, the visualization below demonstrates the benefit of viewing multiple supplier performance metrics together to get a comprehensive picture that is otherwise difficult to get through multiple separate reports.

Using analytics, a procurement team can determine the optimal supplier for critical project completion. By comparing suppliers according to delivery performance, quality, and spend amount, procurement officers can more fully understand where inherent risk lies. When faced with a tight timeline, the volume of rejected shipments by one vendor may outweigh the benefit of their lower-priced offering. To avoid the risk of stock-outs, supplier diversification may be necessary.

Why procurement analytics from Oracle?

Whether pre-built via Fusion ERP Analytics or DIY using Oracle Analytics Cloud, Oracle provides comprehensive procurement analytics offerings. Within the procurement space, the automation of routine tasks has become table stakes, while a comprehensive understanding of spend and supplier risk provides companies with multiple paths to greater profitability.

At Oracle, we believe that technology solutions must rise to meet the new demands of the procurement role. Our cloud procurement and advanced analytics solutions have been built to facilitate strategic decision-making for procurement teams as they navigate complex supply chain challenges. To learn more about the benefits of procurement analytics, check out our latest product tour.

Visit Oracle.com/analytics, and follow us on Twitter@OracleAnalytics and LinkedIn.